JUST SOLD! This 2 bedroom and 2 bath, 1401 sq ft home overlooking the golf course in the 55+ community of Oakmont sold over the asking price to close at $845,000 after only one day on the market! The buyers made a pre-emptive offer the seller couldn’t refuse. The views of mountains and skies are unbeatable and one-of-a-kind from this home! The strong seller’s market continues in Sonoma County, CA. There are rumors at this writing ( 6/20/22) that the housing bubble will burst with inflation looming in the future and higher interest rates (5.87%) are keeping buyers out of the market.

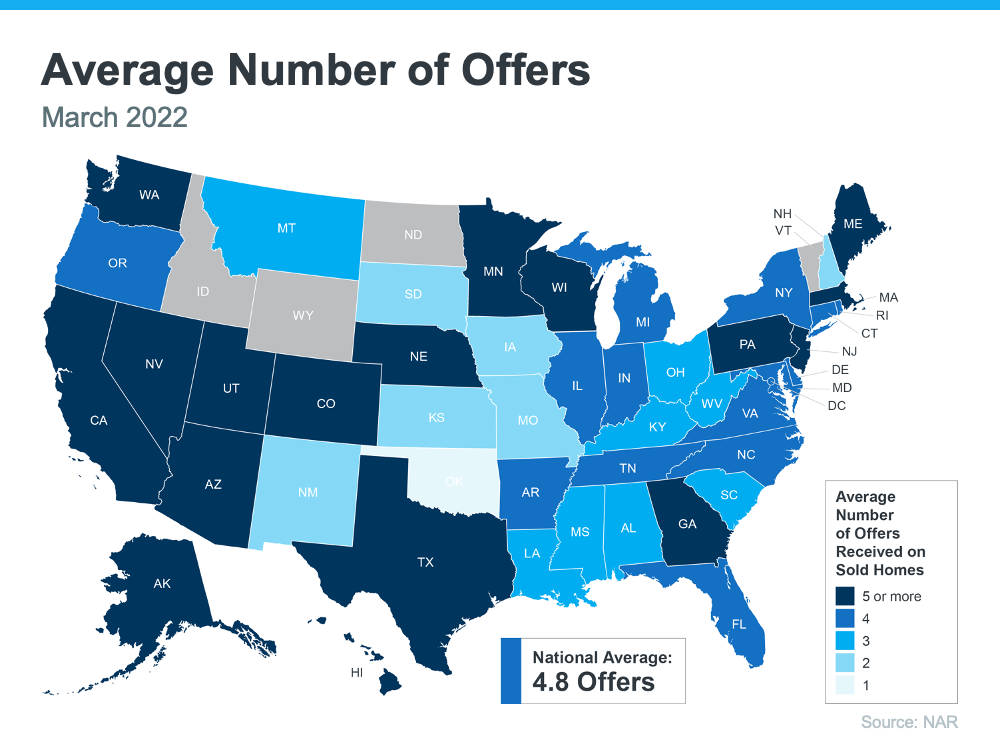

Not so, in my opinion. The laws of supply & demand and the low-housing inventory are keeping the real estate market alive. There continues to be over bidding with all cash offers winning! Especially, in the specialized retirement sector of the Sonoma Valley. Oakmont is experiencing a shortage of inventory,(supply & demand) which makes for multiple offers.. It’s a true seller’s market! Will it last?! Who knows? Many experts predict a crash coming.

But there will always be market fluctuations, ups and downs, the market is cyclical and right now, the market is up. And so are the interest rates. Many buyers in the 55+ second home market are flush with cash and so unaffected by the mortgage rates. This drives the retirement sector. But higher interest rates shouldn’t stop a buyer. I remember buying my first home when the interest rates were $11% (1986)..seems absurd, doesn’t it? So really, the current interest rates are historically, not that bad. Those buyers who still want to own a home will drive this strong market. It’s the “American Dream” to own a home. ..and it makes good economic sense. Real Estate continues to be the best investment over stocks and other investment vehicles over the long haul.

It’s been over thirty-five years now since I bought my first/only home…I’ve weathered the bubbles, the refinancing ups and downs of interest rates, home improvements and disasters (2017 Wildfires) and I’m ahead investment-wise. It’s the American Dream!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link